The Gartley Pattern-How to Identify it on The Chart

In continuation of our series on harmonic pattern Identification. Today we’re going identify the Gartley Pattern, another pattern formation ...

https://socfx.blogspot.com/2015/09/the-gartley-pattern-how-to-identify-it.html

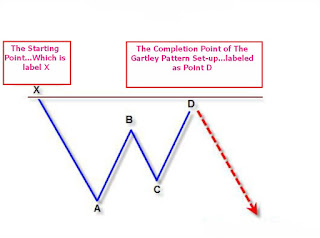

In continuation of our series on harmonic pattern Identification. Today we’re going

identify the Gartley Pattern, another

pattern formation that occurs frequently as well on the financial market or any

other instruments just like the Alternate

Bat Pattern. The success or win-rate of this pattern is around 80%, which

is great in the world of real, trading methods.

The Gartley

Pattern Formation in Summary:

·

The A-B leg

retraces about 61.8% of the X-A leg (Very critical for identification of the

pattern)

·

The B-C leg

retraces 38.2% to 88.6% of the A-B leg

·

The C-D leg

ends at around 127% to 161.8% of the B-C

leg (projection)

·

The C-D leg

ends also at around 78.6% retracement of the major X-A leg or

·

The C-D leg ends

at around 113% of the X-A leg extension.

The Bearish Bat Pattern:

This pattern as

illustrated in the image below is more like an W-type formation that makes use

of the 78.6% and occasionally 113% XA leg retracement and extension of the

Fibonacci tool, as the defining support level in the Potential Reversal

Zone{PRZ}.And the BC projection use an extreme harmonic ratio that is at least

a 127%% extension.

You might want to read my post on A Cheat Sheet or a Quick Guide In Identifying Harmonic Patterns

The Bullish Bat Pattern:

This pattern as

illustrated in the image below is more like an M-type formation that makes use

of the 78.6% and occasionally 113% XA leg retracement and extension of the

Fibonacci tool, as the defining support level in the Potential Reversal

Zone{PRZ}.And the BC projection use an extreme harmonic ratio that is at least

a 127%% extension.

How To Trade This Pattern:

Now how do

we plan a trade around this nice formation in order to make some real dough?

The answer is not

far-fetched.

Your entry would be to buy or sell the area where the 78.6%

of X-A and 127% of B-C meet or at most at around 113% of X-A leg. I love

entering a trade using a base pattern set-up formation.

·

Your stop

loss would be below the origin of the X-A. Meaning below the high or low

that is X or above 113%

·

For targets,

some traders use the 61.8% as a minimal target, and copy the X-A leg and

project it from the point D for the extended target of 127%.

·

For trailing

your stop, you can raise it to a break-even as soon as the minimal target is

achieved.

Now let’s look at a real trading scenario on how to identify this

pattern in an extreme bullish market condition and trading the reverse…lets go

guys!

Since we're looking to trade bearish Gartley...looking at the above chart price price rallied and retraces to create the X-A leg and rallied again to create the B point and then retraces again,please the see what transpired later the pattern forms,see image below:

Now to add to the accuracy of predicting the price reversal level at D, we look at the 78.6% or 113% or extension retracement of X-A or , and the 127% projection of B-C. Below is the rest of the pattern lines on the price action.

Below is the aftermath of what happened , price eventually rallied to the 113% of X-A leg and tested the entire zone before nose-diving and hitting targets.

Use the comment box below and express yourself!